Private Health Insurance Rebate & Medicare Levy Surcharge changes

Changes to the Private Health Insurance Rebate & Medicare Levy Surcharge for 2012/13 Financial Year.

From 1 July 2012, the following changes will take effect:

- Private Health Insurance Rebate will be means tested against three income tear thresholds.

- The Medicare levy surcharge (MLS) income test will change.

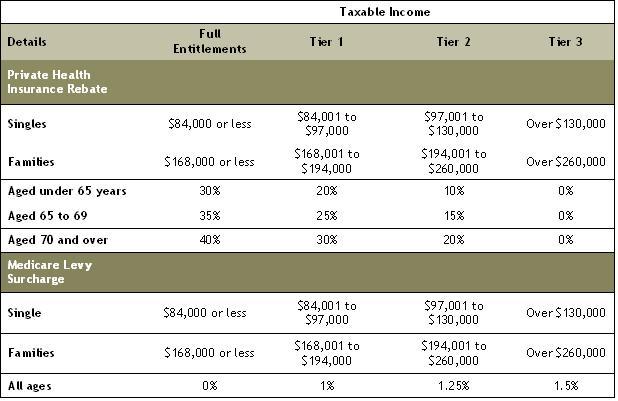

The income thresholds that apply to the 2012/13 financial year are:

* The family income threshold is increased by $1,500 for every child after the first child

With these changes in mind, consideration should be given as to the financial effect of private health insurance cover. It may be possible to retain the full 30% rebate currently available for private health insurance premiums for the 2012/13 year if the premium is prepaid before 1 July 2012.

For further clarification on how these changes may impact you, please contact Stature ARW Accounting on 02 8256 2100 or at info@staturearw.com.au.

Source: Australian Government Department of Health and Ageing website - http://www.health.gov.au/privatehealth