50 per cent investment allowance

Back to front page

The Federal Government has recently passed the 50 per cent investment allowance and it is now law.

The increased investment allowance is now 50 per cent for small businesses and increases the business tax break for NEW assets purchased between

13 December 2008 and 31 December 2009.

The increased investment allowance of 50 per cent applies to businesses with a turnover of less than $2m. For all other businesses, the previously announced 30 per cent (to 30 June 2009) and 10 per cent (from 1 July 2009) investment allowances continue to apply.

The allowance will be offered on almost all new plant and equipment, vehicles and other assets costing over $1,000. The investment allowance will be confined to new assets and new expenditure on existing assets, used in Australia. Assets that have previously been used or held for use will be excluded.

Land, trading stock and buildings are excluded from the definition of depreciating assets and will not qualify for the investment allowance.

There is a significant misconception in relation to this new investment allowance, as it is often overstated by sales people. The 50 per cent investment allowance is essentially an additional tax deduction, which is different to a 50 per cent tax refund as it is often promoted.

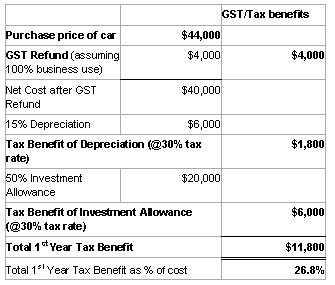

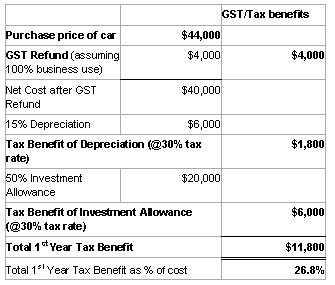

Here is an example highlighting the tax benefits of buying a new $44,000 car, when the business is registered for GST with a tax rate of 30 per cent.

The allowance will be claimed through the income tax return in which the first depreciation is claimed for the asset. As only new cars are eligible for the new investment allowance, it may now be better to buy new business cars rather than used cars but please contact us first because there may be other implications to consider, including Fringe Benefits Tax (FBT).

Back to front page

|

|

Article brought by Stature ARW Accounting

Stature ARW formerly (Adrian Raftery Wawrzyniak) is a young & innovative boutique practice based in the Sydney CBD, with western Sydney offices in Granville and Campbelltown. We also have a branch office in Cairns, Queensand and are available in Melbourne on a part-time basis.

Our size and expertise allows us to provide a quality, personalised service with direct access to partners and proactive solutions at a realistic price.

We offer services to individuals, family businesses & small/medium enterprises in each of our core competencies.

View Our Services

|

What's new?

Book in your 2009 tax return appointment now!

We recommend you get in early and book now so that you can see your ARW representative for this year's tax return. Email Kylie now

Rafters to run marathon as leprechaun!

He definitely isn't your boring accountant. Read all about it here. Also join his Facebook Group.

PAYG withholding (221D) variations for 2009/10

For those clients with income tax variations in place for their investments, we recommend that you get in contact with us to have the variation in place for 2009/10 tax year ASAP.

Tax effective opportunities closing in 2 weeks!

A reminder that most tax effective investment opportunities close very soon. To get a sizeable tax deduction this year then you must act swift & contact us now .

Get an extra $1,500 from the Government

Just a reminder that for those eligible to receive the Government Co-Contribution to make your $1,000 post-tax contribution into super before 30 June.

Get a rebate back on commissions

It only takes a few minutes for ARW to put money back in your pocket that is going into someone else's. Click here.

Granville & Campbelltown offices open Saturdays

Between July & November our Granville (1 Membrey St) & Campbelltown (6 King Street) offices will be open on Saturdays between 9am - 5pm.

30 June last date for super guarantee tax deductions

30 June is the last day for businesses to pay super guarantee and qualify for a tax deduction for this financial year.

Get your stimulus payment

Over 500,000 are yet to lodge their 2008 tax return. Are you one of them? Must act before 30 June so book an appointment via Kym now.

2008/09 superannuation age-based deduction limits

Under 50 $50,000; 50 & over $100,000

Cancellation fee

As our time is valuable, ARW is imposing a $55 cancellation fee for no shows & meetings cancelled within 24 hours of the appointment. Please take care when making a booking.

Free tickets to Souths home games

Clients interested in tickets to Souths home matches can register their interest here.

Beware ATO email scam

Please ignore any email from ATO about potential refund as it is a fake.

|

|