Business travel rates

The Tax Office is soon to release its 2010/11travel, accommodation and meal allowance rates.

When claiming travel allowance expenses and overtime meal allowance expenses the following key points must be remembered:

- The claim must be allowable

A deduction claim cannot exceed the amount actually incurred for work-related purposes. The payment of an allowance does not of itself allow a deduction to be claimed. - An allowance must be paid

The substantiation exception only applies if the employee is paid an overtime meal allowance or a travel allowance. The allowance must have an identifiable connection with the nature of the expense covered. - For travel allowance expenses location is important

The employee must sleep away from home. - The substantiation exception may be applicable

Where the amount claimed is no more than the applicable reasonable amount, substantiation of the claim with written evidence is not required. - Claims in excess of reasonable amounts may require substantiation

If the amount claimed is more than the reasonable amount, the whole claim must be substantiated with written evidence, not just the excess. - Reasonable claims may still need verification

In appropriate cases, where the substantiation exception is relied on, the employee may still be required to show:- How they worked out their claim

- An entitlement to a deduction (for example that work-related travel was undertaken)

- A bona fide travel allowance was paid

- If accommodation is claimed, that commercial accommodation was used.

The nature and degree of evidence will depend on the circumstances. For example, the circumstances under which the employer pays allowances, the occupation of the employee, and the total amount of allowances received and claimed during the year by the employee.

For a detailed listing of the 2009/10 ‘reasonable amounts’ as outlined by the Tax Commissioner go to the Appendix below. The 2010/11 business travel rates will be included in the next issue.

Appendix: Business Travel Rates 2009-10

Travel Claims Within Australia 2009-10

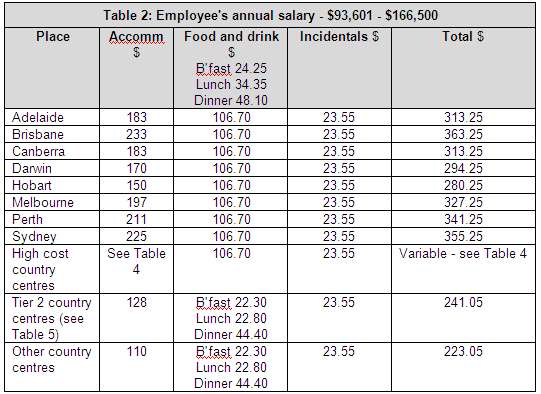

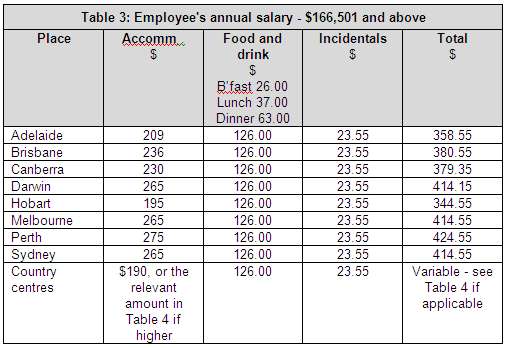

The reasonable amounts for daily travel allowance expenses, according to salary levels and destinations, for the 2009-10 income year are shown in Tables 1 to 6 as follows.

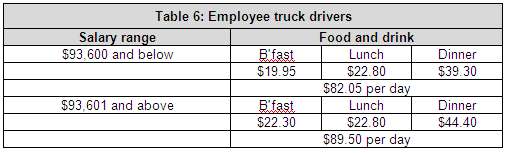

Reasonable travel allowance expense claims for employee truck drivers

Amounts claimed up to the food and drink component only of the reasonable domestic daily travel allowance amounts for 'other country centres' are considered to be reasonable for meal expenses of employee truck drivers who have received a travel allowance and who are required to sleep away from home. For the

2009-10 income year, the relevant amounts are:

Travel Claims Overseas 2009-10

If a country is not listed in Table 1 below, use the reasonable amount in Table 2 for Cost Group 1. For an explanation of Cost Groups see the table below.

|

Country |

Cost Group |

Country |

Cost Group |

|

Albania |

2 |

Estonia |

3 |

|

Algeria |

4 |

Ethiopia |

1 |

|

Angola |

6 |

Fiji |

2 |

|

Antigua and Barbuda |

4 |

Finland |

5 |

|

Argentina |

2 |

France |

6 |

|

Austria |

5 |

Gabon |

6 |

|

Azerbaijan |

5 |

Gambia |

3 |

|

Bahamas |

6 |

Georgia |

3 |

|

Bahrain |

3 |

Germany |

5 |

|

Bangladesh |

2 |

Ghana |

2 |

|

Barbados |

5 |

Gibraltar |

3 |

|

Belgium |

4 |

Greece |

4 |

|

Bermuda |

5 |

Guatemala |

2 |

|

Bolivia |

1 |

Guyana |

2 |

|

Bosnia |

2 |

Hungary |

3 |

|

Brazil |

4 |

Iceland |

5 |

|

Brunei |

2 |

India |

4 |

|

Bulgaria |

3 |

Indonesia |

3 |

|

Burkina Faso |

3 |

Iran |

1 |

|

Country |

Cost Group |

Country |

Cost Group |

|

Cambodia |

2 |

Irish Republic |

5 |

|

Cameroon |

4 |

Israel |

4 |

|

Canada |

4 |

Italy |

5 |

|

Chile |

2 |

Jamaica |

3 |

|

China (includes Macau & Hong Kong) |

4 |

Japan |

6 |

|

Colombia |

3 |

Jordan |

4 |

|

Congo Democratic Republic |

3 |

Kazakhstan |

3 |

|

Cook Islands |

3 |

Kenya |

3 |

|

Costa Rica |

2 |

Korea Republic |

4 |

|

Cote D'Ivoire |

4 |

Kuwait |

4 |

|

Croatia |

3 |

Laos |

2 |

|

Cuba |

3 |

Latvia |

3 |

|

Cyprus |

4 |

Lebanon |

3 |

|

Czech Republic |

4 |

Libya |

3 |

|

Denmark |

6 |

Lithuania |

3 |

|

Dominican Republic |

3 |

Luxembourg |

4 |

|

East Timor |

2 |

Macedonia |

2 |

|

Ecuador |

2 |

Malawi |

2 |

|

Egypt |

3 |

Malaysia |

2 |

|

El Salvador |

2 |

Mali |

3 |

|

Eritrea |

2 |

Malta |

4 |

|

Mauritius |

2 |

Senegal |

3 |

|

Mexico |

2 |

Serbia |

2 |

|

Monaco |

6 |

Sierra Leone |

4 |

|

Morocco |

3 |

Singapore |

4 |

|

Mozambique |

2 |

Slovakia |

4 |

|

Myanmar |

4 |

Slovenia |

3 |

|

Namibia |

2 |

Solomon Islands |

2 |

|

Nepal |

2 |

South Africa |

1 |

|

Netherlands |

5 |

Spain |

4 |

|

New Caledonia |

5 |

Sri Lanka |

2 |

|

New Zealand |

3 |

Sudan |

4 |

|

Nicaragua |

2 |

Surinam |

3 |

|

Nigeria |

4 |

Sweden |

4 |

|

Norway |

6 |

Switzerland |

5 |

|

Oman |

4 |

Syria |

3 |

|

Pakistan |

2 |

Taiwan |

3 |

|

Panama |

3 |

Tanzania |

2 |

|

Papua New Guinea |

3 |

Thailand |

3 |

|

Paraguay |

1 |

Tonga |

2 |

|

Peru |

3 |

Trinidad and Tobago |

4 |

|

Philippines |

2 |

Tunisia |

2 |

|

Poland |

3 |

Turkey |

4 |

|

Portugal |

4 |

Uganda |

2 |

|

Puerto Rico |

4 |

Ukraine |

3 |

|

Qatar |

4 |

United Arab Emirates |

5 |

|

Romania |

3 |

United Kingdom |

5 |

|

Russia |

5 |

United States of America |

4 |

|

Rwanda |

3 |

Uruguay |

2 |

|

Saint Lucia |

3 |

Vanuatu |

3 |

|

Saint Vincent |

3 |

Venezuela |

5 |

|

Samoa |

3 |

Vietnam |

2 |

|

Saudi Arabia |

3 |

Zambia |

2 |

Table 2: Reasonable amounts by cost groups